Rolls-Royce (LSE:RR.) shares have been standout performers among FTSE 100 stocks in 2023. Having risen by an astonishing 144% in less than a year, potential investors might be forgiven for asking themselves whether the Rolls-Royce share price is now rather expensive.

Yet, despite trading near a 52-week high, the stock is still down 17% from where it was five years ago. Long-term shareholders will hope the aerospace and defence giant’s post-pandemic recovery has further to run. After all, at £2.41 today, the share price is still well below the all-time high of £4.42 it reached back in 2014.

So, let’s take a closer look at the Rolls-Royce’s investment prospects today.

Should you invest £1,000 in Rolls-Royce right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Rolls-Royce made the list?

Valuation

First, it makes sense to tackle the subject of valuation head on.

Since the company generates nearly 47% of its revenue from delivering and maintaining civil aircraft, it suffered enormously in the pandemic due to strict travel restrictions. During this period, Rolls-Royce was a loss-making business.

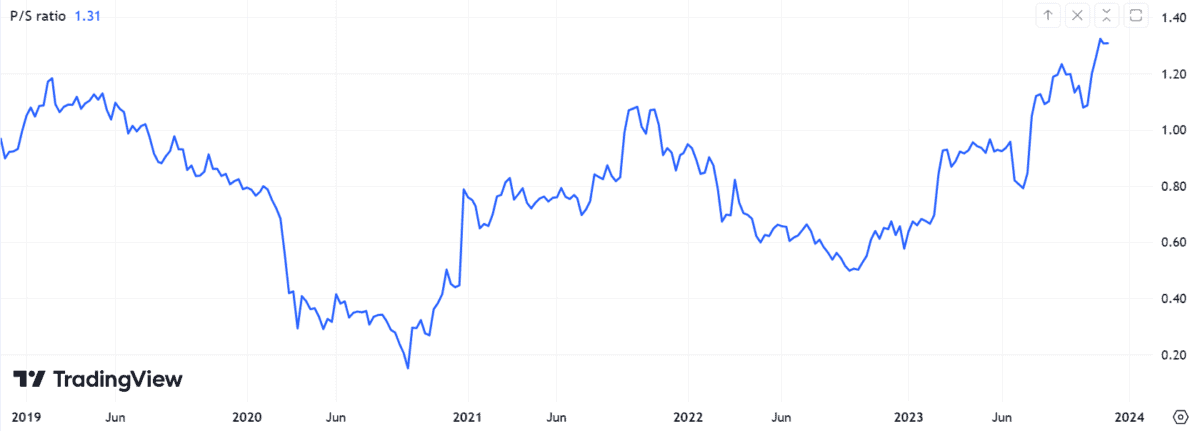

Therefore, I believe it’s more enlightening to look at the firm’s price-to-sales (P/S) ratio, rather than the more widely used price-to-earnings (P/E) ratio, to gauge its valuation today.

As the chart above shows, Rolls-Royce shares are currently more expensive, according to this metric, than they have been at any point in the last five years.

Consequently, value investors may have legitimate concerns that the company will struggle to generate similar returns in 2024 compared to the last 12 months.

Net debt

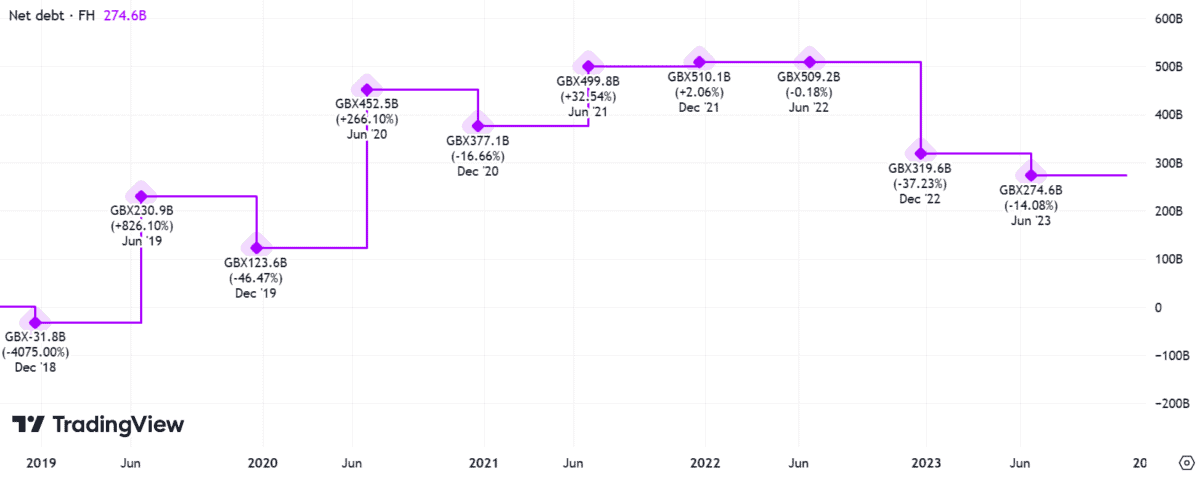

Turning to the balance sheet, Rolls-Royce has made good progress in reducing the debt mountain it built during the pandemic. In H1 2023, this figure improved to £2.75bn, having ballooned to £5.1bn by the end of 2021.

All the major credit rating agencies now have a positive outlook on Rolls-Royce. That said, the group has yet to return to an investment-grade rating.

| Agency | Credit Rating |

|---|---|

| Moody’s | Ba3 |

| Fitch | BB- |

| S&P | BB |

Free cash flow

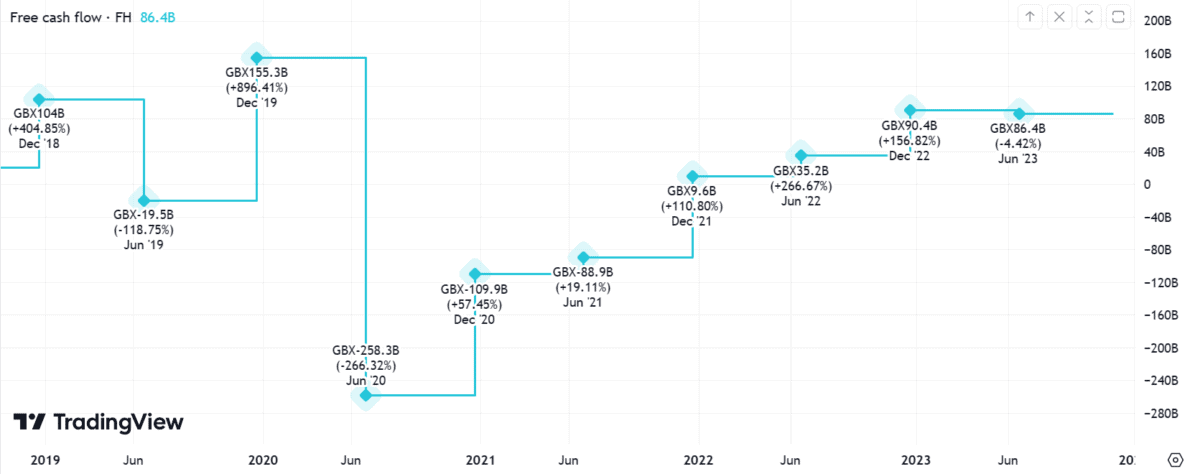

I’d like to see the company generate stronger cash flows over the coming years, as it has only recently stemmed its outflows — but the trajectory looks encouraging. This might translate into rating upgrades down the line.

CEO Tufan Erginbilgic has acknowledged the company was slow to respond to the inflationary environment with price hikes for its services.

This could bode well for future cash flow improvements. Rolls-Royce arguably has headroom to capitalise on its competitive advantages in raising prices further.

Profitability

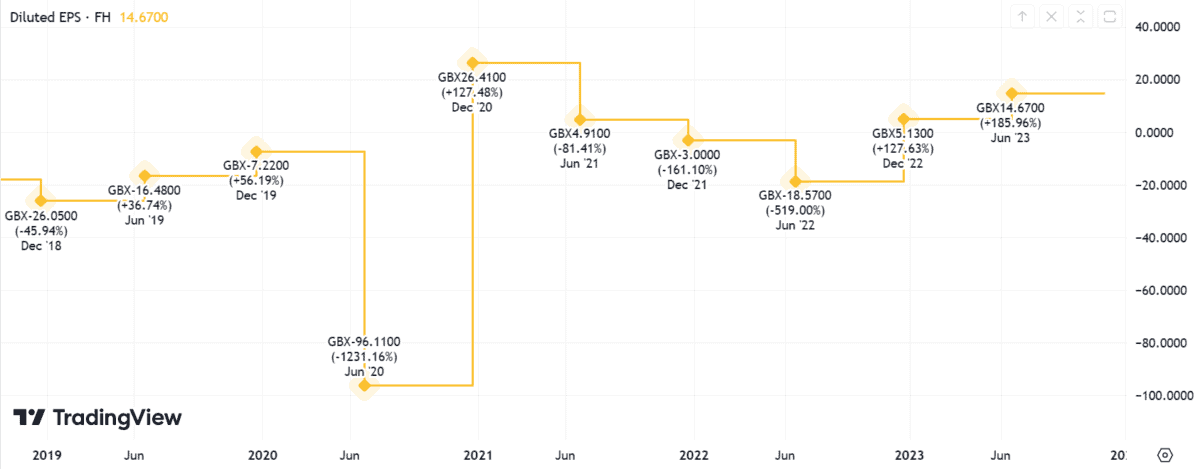

Finally, diluted earnings per share (EPS) are nearly back to where they were pre-Covid.

This crucial profitability metric is the figure that really catches my eye. It tells the story of Rolls-Royce’s remarkable turnaround under Erginbilgic’s leadership.

A stock to buy?

It’s fair to say growth in the Rolls-Royce share price over the past year has been nothing short of spectacular.

A continued recovery in civil aviation flying hours, lucrative submarine deals flowing from the AUKUS defence pact, and ground-breaking technology for small modular nuclear reactors all add weight to the investment case.

However, the stock isn’t as cheap as it was. Investors might be wise to limit their expectations if entering positions today. Nonetheless, I’m a shareholder and will continue to hold my position with the prospect of potential dividend reinstatements on the near horizon.